This is a crucial document for businesses in the United States as it serves as the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. By submitting federal tax form 7004, eligible organizations can request an automatic extension on their income return filing deadlines, allowing them more time to compile and submit the necessary information and paperwork. It is important to note that it does not extend the time to pay taxes, only the time to file the required returns.

Our website 7004-federal-form.com is a valuable resource for businesses seeking assistance with filing the application. We offer comprehensive IRS tax form 7004 instructions, examples, and other essential materials to help users complete the blank template accurately and efficiently. By providing clear guidance on the various sections and requirements of IRS Form 7004 for an extension of time, the website ensures that businesses can confidently request the prolongation and avoid potential penalties associated with late or improperly filed tax returns.

Federal Tax Extension Form 7004: Terms to Fill It Out in 2023

The application for a time extension to file business income tax and other returns must be filed by businesses in the United States that cannot submit their annual declarations by the original due date. This includes corporations, partnerships, limited liability companies, trusts, and estates required to file income tax, information, or other returns under specific Internal Revenue Code sections.

However, there are certain cases when using federal tax extension form 7004 is not allowed:

- Individuals filing personal income tax returns.

- Non-profit organizations filing Form 990.

- Estates filing Form 1041-A.

- Foreign trusts with U.S. owners submitting Form 3520-A.

- Employee benefit plans filing Form 5500 series.

Completing Federal 7004 Tax Form: Rules & Tips

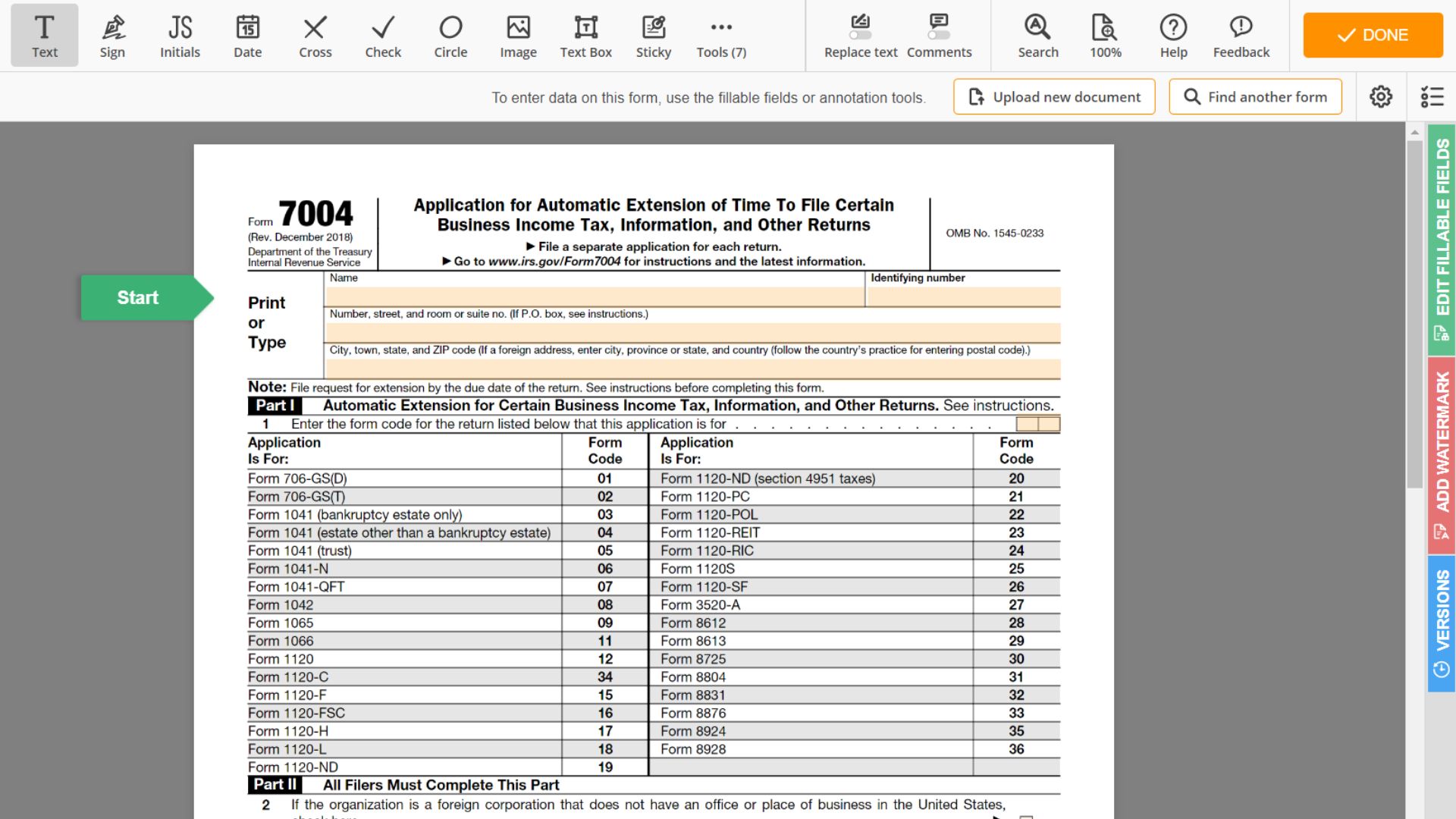

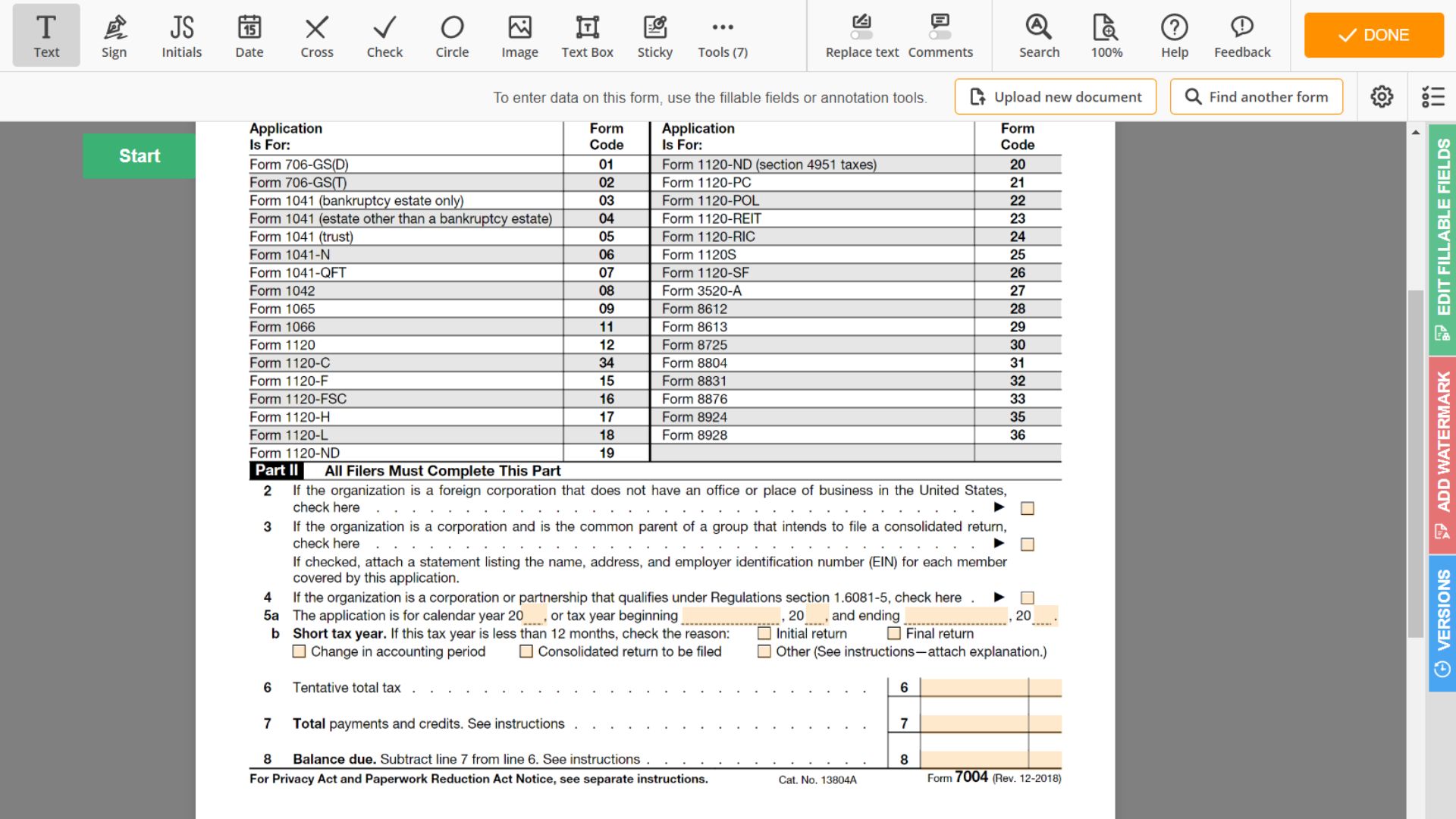

Filling out irs tax form 7004 for an extension of time can be confusing. Here's a step-by-step guide to help you complete this template correctly:

- Get a blank IRS Form 7004 example on any website you trust or use online tax software to fill it out digitally.

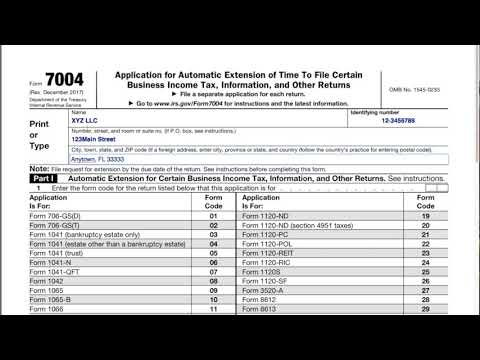

- Determine the type of tax return you're requesting an extension for and enter the corresponding code in the box provided.

- Fill out IRS Form 7004 with the business name, address, and employer identification number (EIN) in the designated fields.

- Enter the beginning and ending dates of the year for which you request an extension.

- Estimate the total fiscal obligations for the relevant year and enter it in the appropriate box.

- Enter the total payments and credits applied to the fiscal obligations.

- Subtract the payments from the financial obligations to determine the balance due, if any.

- After reviewing the tax form 7004 instructions and ensuring accuracy, print and sign the sample. Make sure to include your title and a contact phone number.

- File IRS Form 7004 to the appropriate address or electronically through the e-file system before the return's original due date.

Following the steps in IRS 7004 form instructions, you can complete and submit your sample to obtain an extension for your business tax filing.

Top Questions About the 7004 Form for Businesses

- How can I file IRS Form 7004 online?

You can use the IRS' e-file system or choose an authorized e-file provider that supports business tax extensions. Filing online is secure, fast, and convenient, allowing you to receive confirmation of your extension request immediately. - What is the purpose of Federal Form 7004 for the 2022 tax year?

The purpose is to request an automatic extension of time to file specific business income tax, information, and other returns. By filing this sample, eligible taxpayers can receive an extension of up to six months, depending on the tax return filed. - Can I find an IRS Form 7004 fillable version to complete on my computer?

You can obtain a fillable version on the IRS website. This allows you to complete the template electronically, which can be more convenient and reduce the risk of errors. After filling out the PDF, you can either print and mail it to the IRS or submit it through the e-file system. - Where can I find a 7004 form sample to use as a reference?

You can find it on the Internet or by searching for financial advisors and online resources that guide completing the blank 7004 templates. These samples may include annotations or explanations to help you understand each section and ensure you provide the correct information. - If I need a physical copy, where can I print IRS Form 7004?

You can print it out from any trustworthy website available in PDF format. Once downloaded, you can open the sample using a PDF reader and print it using your home or office printer. Alternatively, you can visit your local IRS office or library to obtain a printed copy of the 7004.

Federal Form 7004 - Tax Extension Request

Federal Form 7004 - Tax Extension Request

7004 Form Instructions

7004 Form Instructions

IRS Form 7004 Guide

IRS Form 7004 Guide

Federal Tax Extension Form 7004 Instructions

Federal Tax Extension Form 7004 Instructions

E-file Form 7004 PDF to the IRS in 2023

E-file Form 7004 PDF to the IRS in 2023